Algorithms to classify nature-based projects

From satellite data to project classification

Every project needs to register a set of GPS coordinates that demarcate the land area covered by the carbon credit generation. When a project is registered, our goal is to apply algorithmic classification of the historicalsatellite data for that region to determine certain properties for the timespan covering the lifetime of the project intervention.

- Additionality determines project outcomes that would not be otherwise achieved without the funding from the carbon credits

- Permanence defines the endurance of additionality beyond the intervention window of the project.

- Leakage covers the displacement of negative externalities from the current project to other geographies, either nearby or through the global supply chain.

Let's look into what each of these metrics is in more detail, and why they must be used in combination to calculate accurate estimates about the value of funding interventions. For all the techniques, more details are in our working whitepaper which is available on request.

Additionality

The calculational of additionality determines the level of project outcomes that would be not otherwise be achieved without the intervention of the funded project. It is calculated for a fixed time period that represents a project, which is tied to the landowner who both receives payment and is accountable for ensuring the project outcomes occur.

The current practice, widely employed by carbon accreditation bodies, is to measure the carbon additionality of a project against a scenario-based assessment of realistic and credible land-uses that would occur in the absence of the project. Projects employing this practice, including California’s forest carbon offsets programme (the largest in the world) are now falling foul of serious pushback through criticisms that the scenarios adopted lead to serious over-estimation of carbon benefits. Another common practice is to identify a reference area that is apparently similar to the anthropogenic and environmental context of the project site. Carbon additionality is then measured against the reference in an ex-post manner. However, the problem with this approach is that unmeasured variables, such as differences in transport infrastructure or topography, make these sites fundamentally different in their exposure to drivers of habitat conversion and hence inappropriate for assessing additionality.

We instead measure additionality using two econometric techniques in combination:

- project treatment effect estimation through difference-in-difference (DiD) analysis.

- generation of a control group using pixel matching that is used to estimate the business-as-usual scenario.

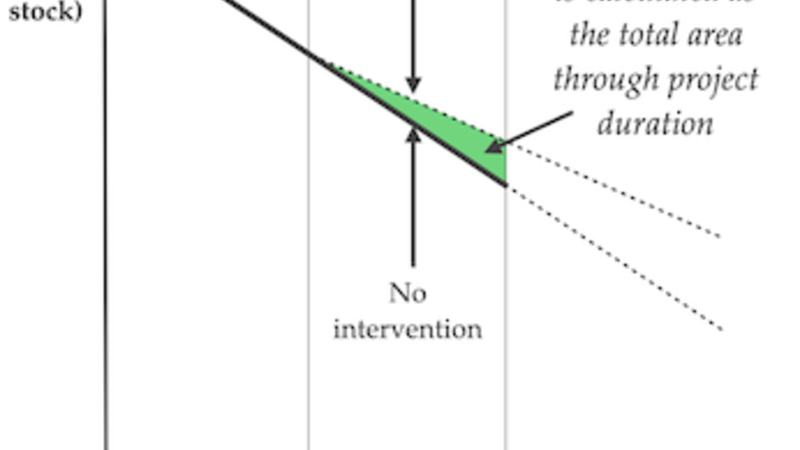

The graph above shows two lines: the solid one being the state of the forest carbon stock without intervention, and the counterfactual measurement of what would happen with intervention calculated via the two techniques above from historical satellite data.

Leakage

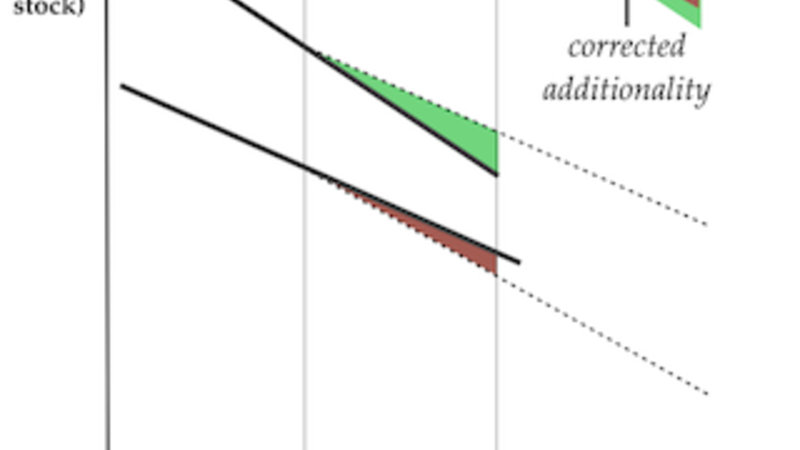

Leakage arises where production opportunities are forgone as a result of the project lead to that production and its attendant impacts being shifted elsewhere. Consequently, any emissions caused by leakage from the project should be accounted for and subtracted from the credits generated through the additionality calculation above.

Current practice is that if leakage is considered at all, it is often first predicted using default market leakage rates, which estimate leakage as a function of forgone production from improved forest management, but not where activities are displaced outside the host country. Past changes in emissions in the area surrounding or immediately outside the project (the leakage belt) may be used to quantify local leakage, which is expected as a result of local adjustments in land use.

However, such analyses rarely include consideration of counterfactual outcomes in the leakage belt and so focusing on local leakage alone may be insufficient: given the global scope of supply chains, emissions reductions in one place may not uncommonly cause displacement of production activities to other geographies.

Our approach is that local leakage is measured using DiD in the same way as additionality (above), using counterfactuals for leakage zones as well as project sites. Project impacts net of leakage are then estimated as the reduction in greenhouse gas emissions created by the project, relative to its counterfactual, minus the additional emissions within the leakage belt, relative to its counterfactual.

Permanence

A carbon credit is generated through the net reduction of atmospheric greenhouse gas by one tonne of CO2 but the duration of this effect may be impermanent. For example, planting trees results in carbon sequestration during each growing season over the next several decades. In many cases, some of the sequestered carbon is re-emitted after some period of time. Continuing with the example, a forest may re-emit carbon due to the decomposition of forest litter. Catastrophic re-release may also occur due to fires or logging.

Our goal is to assign a metric to a carbon offset given that the sequestration is not instantaneous and that carbon can be subsequently re-released. The state of the art in estimating permanence is to offer narrative arguments to imply that the nature-based carbon stock in question is stored for long periods. In some cases, non-tradeable credits are held in buffer accounts to insure against unforeseen carbon losses and guarantee permanence. Advocates of geological stock imply that, because NbS credits are susceptible to reversals they can not be considered permanent, and thus they have no offset value. Neither argument is correct.

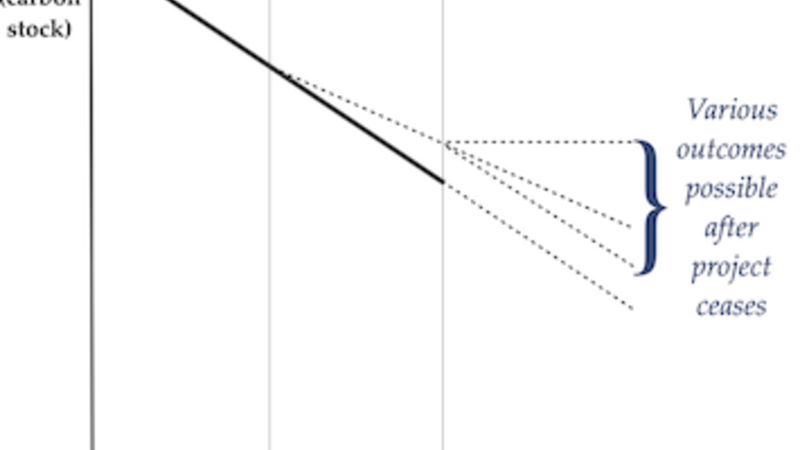

At the end of a project, the enhanced carbon stock may be re-emitted to the atmosphere. While the probability of re-emission is minute for the carbon stored in a geological state, nature-based carbon stocks have a higher probability of re-emission.

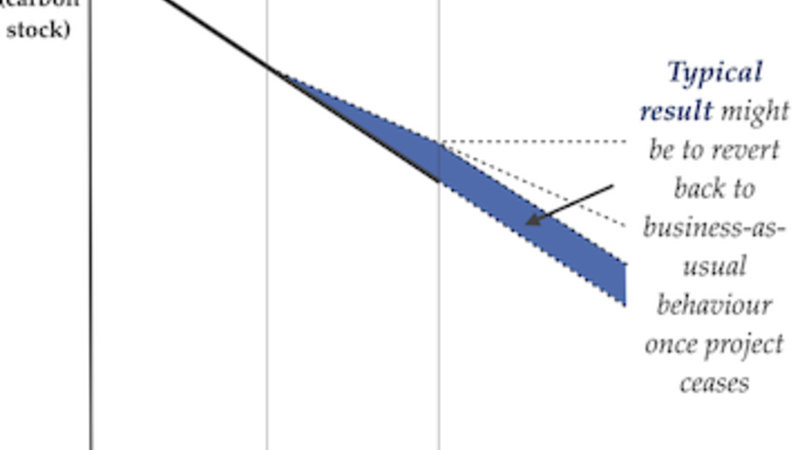

One plausible forecast is that in the absence of the carbon project, emissions revert to the business-as-usual rate. For example, deforestation recommences but not faster than average, given the environmental conditions.

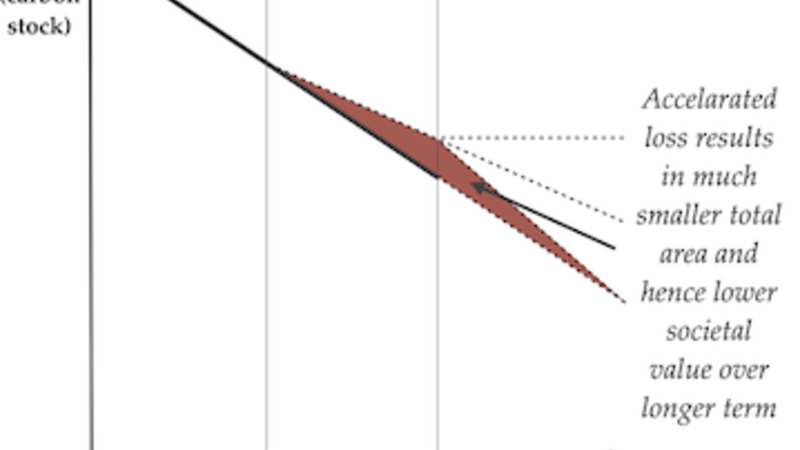

Alternatively, it is possible that the emissions rate is accelerated or, in the worst case, carbon stocks are re-emitted instantaneously through a catastrophic failure, such as a fire that burns through the project site.

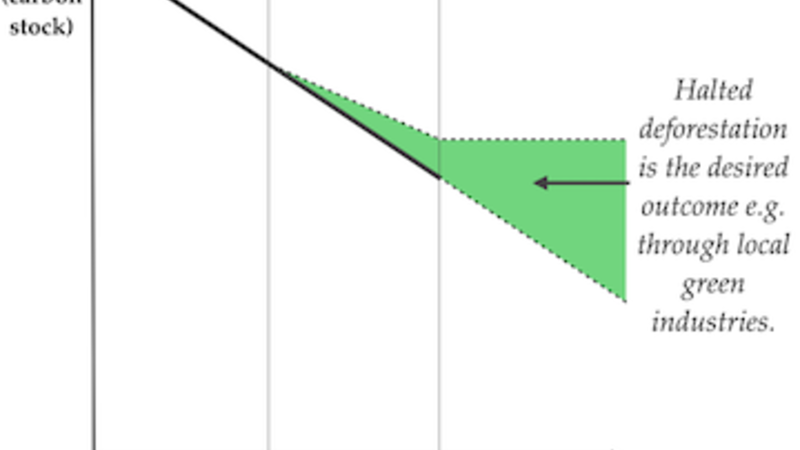

And in some circumstances, a sufficiently good investment in the local population (for example, building local green industries to generate even more income than the original project intervention) may result in land use stabilisation. This is the ideal result.

However, under any of these scenarios, there is an area between the project and the counterfactual curves – that is to say that despite eventual re-emission the project has value by preventing some annualised emissions during the project duration.

Assigning a value to carbon sequestration

The calculation of project additionality, corrected by leakage, and adjusted for eventual permanence gives us the framework with which we can assign a concrete carbon credit value to a given project zone.

The driver behind our cost metric is that carbon release causes damage through various pathways over decades to centuries. The value metric attempts to capture this cost, with a discount factor to reflect the present-day value of future events. We thus end up with the value of the permanent removal of one ton of CO2 from the atmosphere at that time. This value, when divided by the size of the project zone, lets us proceed to the next step of creating a trustable marketplace to trade carbon credits.