The 4C marketplace connects nature-based solutions with purchasers of carbon credits through a token marketplace that is driven through trusted primary observations such as satellite imagery. Our algorithmic system is capable not only of retrospectively quantifying the positive externalities that arise from project zones but also of predicting their potential. These two components are essential as verification permits an appropriate number of tokens that represent concrete outcomes to be minted and predictions enable landholders to anticipate the expected gain from changes in land management and avoid deforestation outcomes.

Each token represents a certain amount of carbon sequestration that is intended to offset unavoidable emissions by a purchasing entity. When tokens are minted, they are permanently annotated with primary observational data to allow purchasers to trust the tokens' antecedents, and for tokens to be bought and sold in a marketplace with a guarantee that a token cannot be sold more than once. Tokens can also be buried to prove that the token can no longer be traded so that the entity responsible for delisting can claim moral assignment of the externality. A buried token is permanently marked as such, making it suitable either as a single-use carbon offset against a necessary emission or as proof of funding.

For example, a project that results in the sequestration of an additional 100 tonnes of carbon might be allowed to mint 100 tokens: the purchase of one of these tokens would allow the purchaser to claim 1 tonne of verified carbon offset or to claim their having funded this positive outcome. Such a token would subsequently be verifiably buried once, preventing further resale.

More specifically, our NbS marketplace system aims to be:

- Global: It should support a scalable token market that spans multiple geographies. This is necessary for projects in any part of the world to attract funding.

- Verifiable: It should allow anyone to verify that any aspect of the system meets its specification. For example, primary data should be globally visible, allowing the independent evaluation of token properties. Moreover, all transactions should be visible and immutable, preventing double-counting. This level of verifiability is necessary to build trust in the system.

- Durable: It should last decades since that is how long nature-based projects take to come to fruition. This also implies that it must be incrementally deployable and scalable, and allow analytical algorithms to be improved over time.

- Efficient: It should be possible to directly fund project owners, bypassing rent-seeking intermediaries, thus reducing overheads and transferring the maximum possible value to project owners.

- Liquid: It should allow tokens to be available for resale and portfolio creation. This will allow the creation of an ecosystem of traders and portfolio managers who can help find a market price for tokens and reduce downside risk for investors.

Marketplace Workflow

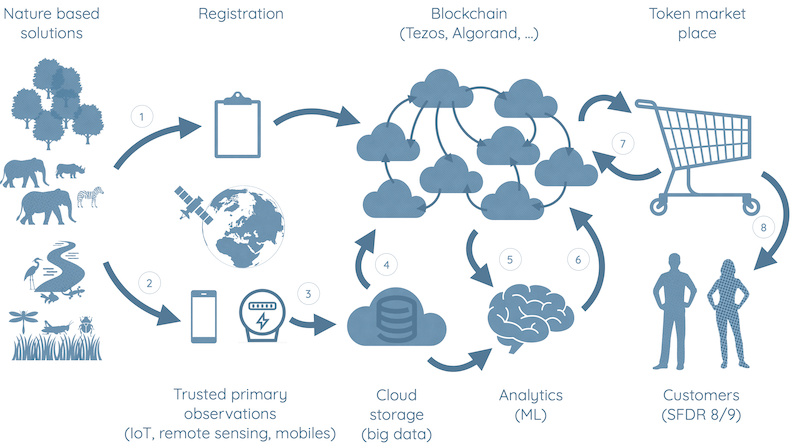

Our system has the following components and associated workflow:

- Ownership of a nature-based solution is demonstrated using existing land ownership records, verified by a trusted third party. Of course, there are situations where ownership is contested or difficult to establish. Thus, we expect this potentially time-consuming step to require expert human input, but it need only be undertaken once per project.

- Trusted primary observations are made using remote sensing technologies, such as satellites or UAVs, which can detect categorical land use classes, indicators of land management, and measurements of carbon density. By compiling time series of such observations we are able to detect stocks and flows of carbon and infer consequences for livelihoods and biodiversity.

- Primary observations are periodically placed in large-scale data storage. The data should be reliably accessible over decadal time-spans, within a decentralized and distributed store that can outlive any single organization. One such store is the Inter-Planetary File System (IPFS).

- Tamper-proof certificates of observations are placed on the Tezos blockchain, which is an efficient decentralised digital ledger operated by a mutually untrusting global set of nodes that agree on a governance and consensus mechanism. This allows the primary observations to be tracked incrementally and allows token purchasers to directly access them to gain confidence in the value of a token, for example by using them to reproduce the algorithmic results for themselves.

- Satellite observations are analysed for additionality (project outcomes that would not be otherwise achieved), the degree of permanence (the endurance of additionality), and lack of leakage (displacement of negative externalities to other geographies). Since the algorithms will evolve over time as the quality of observations improves and the algorithms themselves better estimate these quantities, we keep track of each version of the algorithms used as separate oracles.

- Oracles give permission to project owners to mint a certain number of tokens based looking at past data. Tokens minted for a project are immutably annotated by the oracles to indicate the amount of positive externalities they correspond to. This allows token purchasers to make their own decisions regarding their level of trust in the algorithm's outputs. Moreover, each token's metadata points to the primary observations that justify this assessment. Token metadata also points to the project owner so that the funds, resulting from sales, return to them.

- Tokens can be purchased in a market with the full transparency of the underlying primary observations and algorithms to give confidence to purchasers. Decentralised exchanges convert the tokens into fiat currency (e.g. US dollars) by holding regular auctions.

- The blockchain immutably links the satellite data, algorithms and project owners to their tokens. Tezos smart contracts automatically limit the number of tokens that can be minted and ensure that no tokens can be double-sold, and that all transactions between buyers and sellers are globally visible.

It is important to note that the system is designed modularly, so that all elements of it can be independently upgraded or reproduced by third-parties, or selectively integrated into other NbS systems. All of the source code behind this will be made available under liberal open-source code licenses as each component is launched.

Meeting our design goals

We require the marketplace to be scalable and global to meet the growing needs of NbS projects. The use of satellite imagery and automated algorithmic analysis allows us to scale out the classification of projects much more systematically than is done at present. While this does not completely eliminate the need for manual verification, it significantly lowers the risks involved.

The use of the Tezos blockchain allows us to ensure that the marketplace is:

- decentralised without any single entity being able to modify transactions across the whole system. This is important as we need a globally-accessible and neutral data store to ensure that carbon offsets are not being declared fradulently. The use of IPFS and an energy-efficient proof-of-stake blockchain also allows the marketplace transactions to be highly available without depending on a potential single point of failure.

- verifiable by placing both the trusted primary data in a globally-accessible neutral data store and the algorithms used for classification such that results can be reproduced by third-parties.

- durable for decades, since Tezos has on-chain governance and regular upgrades ensuring that the network can keep up with innovations and serve the needs of NbS projects over a long period of time.

- permissionless for carbon token transactions, which makes it cheap for landowners to register (requiring only a one-off know-your-customer process) and subsequently bypass intermediaries with direct auctions.

- liquid via creation of token portfolios via Tezos smart contracts and decentralised finance (DeFi) techniques, ensuring that market makers can construct aggregate products to hedge risks in one particularl geography. Transactions can also converted directly to-and-from fiat currencies using exchanges, making the holding of token assets for long periods an opt-in mechanism for landowners and purchasers.